Your home loan is one of your biggest expenses.

The good news is that because there are so many lenders in Australia if you shop around you can save serious money on your next home loan.

But shopping around can be hard and confusing. There are lots of questions like:

This is why Loan Comparison Genius exists.

We sort through the confusion and find you the right home loan for your needs. We can guide you through the whole process from start to finish and you won’t have to pay us a cent. Lenders pay us a commission while you pay nothing to save serious money on your home loan. So, sit back and relax while we do all the hard work of comparing home loans and finding the right one for your situation.

This guide will walk you through the key things you need to know to compare home loans and, with our help, find a great deal for you from our panel of over 27 lenders.

With so many home loan lenders in the Australian market you are crazy if you don’t spend the time to compare your options – you can save serious money if you do.

These are the top things you need to consider when comparing home loans:

We will go through each of these below.

This is so important. Before you start looking for a home loan consider what is important to you and your personal circumstances and what your goals and objectives are.

Most people start off saying they just want a low interest rate but maybe you also want things like a low deposit loan, the ability to make additional repayments, a lender with a local branch or easy digital access. There is quite a lot to consider!

This guide will explain some of the ins and outs of finding a home loan. As you read it think about what is most important to you. This will really help you find a loan that suits your personal circumstances.

Finally, if you already have a home loan be sure to read our article on home loan refinancing. It’s full of useful tips and tricks.

A fixed rate home loan means that your interest rate and repayments are locked for an agreed term. This is usually around 1 – 5 years. The great thing about fixed rate home loans is that you have the comfort of knowing exactly what your monthly repayments are and you don’t have to worry about interest rates going up during your fixed term. The downside of a fixed rate home loan is that if interest rates drop you won’t be able to benefit because your interest rate is locked.

These types of home loans mean that your repayments can go up and down depending on whether the Reserve Bank of Australia influences interest rates or your lender decides to charge a higher rate. Historically variable interest rates have been lower than fixed interest rates. Variable home loans are popular with Australians because they allow you to make extra repayments and of course access lower rates – as long as you think interest rates will go down. If they go up, you’ll obviously pay more.

A popular option for some people is to split their home loan and have a portion at a fixed interest rate and the rest variable. This allows borrowers to make extra repayments and have a redraw facility on the variable portion while being less exposed to rate changes because of the fixed portion of the loan. It can be hard to decide what portion of your loan you should fix and what should be variable so make sure you talk to one of our geniuses to get some guidance.

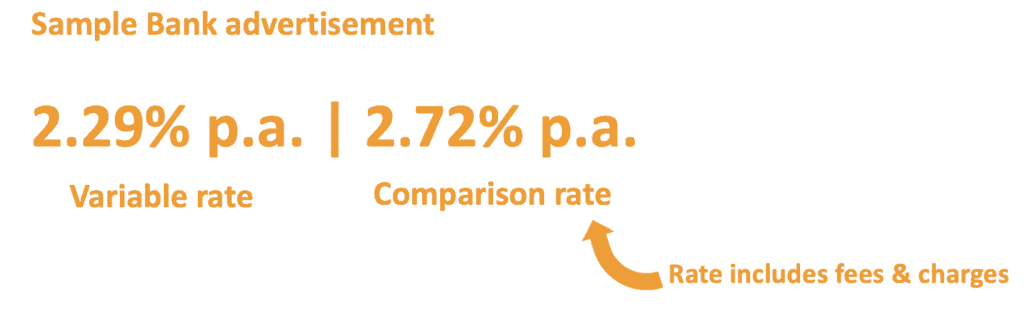

Because some lenders charge higher fees (like application fees and ongoing fees) it can get a little confusing comparing the interest rates from various home loan lenders. To make it clear for borrowers, lenders are legally required to show a comparison rate alongside the variable rate. This comparison rate is shown as an annual percentage rate that includes the home loan’s interest rate as well as most upfront and ongoing fee’s and charges. For example, if a lender says their variable rate is 2.5% per annum and their comparison rate is 2.95% this would mean that the lender has some additional fees and charges that effectively increase the interest per annum. It’s another way to help you compare rates from various home loan lenders.

Home loan lenders offer lower interest rates to borrowers who they believe can repay their home loan.

Some of the factors that could affect the home loan interest rate you are offered include:

Your Deposit

A great way that helps negotiate a lower interest rate on your home loan is by having a good deposit. You should have at least a 20% deposit (20% of the property value). If you have less it’s still possible to get a home loan but you may have to pay a higher interest rate and also get lenders mortgage insurance (LMI – see explanation in the FAQ section) or help from a guarantor.

Your income and expenses

Lenders want to understand if you earn enough to pay off the home loan repayments and cover your living expenses so that you don’t default on the loan.

What is the loan for?

Owner occupiers (people who plan to live in the home they buy) may be offered a lower interest rate than if they were buying the home as an investment.

Assets

If you have other assets like savings, shares, cars, holiday homes or that valuable stamp collection you’ve had since you were a kid, you could be offered a lower home loan interest rate as these assets could be used to pay off your home loan if you experience any difficulties.

Debts

Other debts like credit cards, car loans, personal loans or another property loan can influence the rate a lender might offer you because they may be concerned about the overall debt you have.

Credit Score

If you have paid off your debts and bills on time it’s quite possible you will have a good credit score and therefore be offered a lower interest rate. If you have had trouble paying off debts in the past (for example, you may have missed or defaulted on loan repayments or been declared bankrupt) your credit score may be low and as a result a lender may charge you a higher interest rate.

When you work with one of our geniuses they will help you balance these factors to find a competitive home loan rate for your current situation. You can contact us or start the process online right now!

There are several fees a lender may charge. When you work with Loan Comparison Genius we make sure the lenders fully disclose these fees. You deserve to know all these fees upfront! Here are some of the fees you may be charged:

Annual or monthly fees: Lenders charge this to maintain your loan or for certain features of your loan.

Application fees: Sometimes a lender charges a fee to process your application

Discharge fee: When you pay your loan off in full you might be charged a fee for the privilege! We have never been a fan of this type of fee.

While we dislike these fees and charges, what’s worse is when they aren’t made clear to the person taking out a loan. There is nothing more annoying than discovering hidden fees and charges after you have committed to a loan.

That’s why choosing to work with Loan Comparison Genius is so important. We make sure that lenders fully disclose the fees associated with your loan. We put these fees in our credit proposal disclosure document. This gives you the comfort of knowing you understand the full picture and is part of our comprehensive statement of credit assistance. This is one of the great benefits of working with Loan Comparison Genius – you are fully informed right through the process of finding a home loan.

Finally, you may be charged legal, valuation or settlement fees to cover the legal paperwork, for someone to value your property or to be present when your loan is settled.

When it comes to repayment types there are “principal and interest” home loans and “interest only” home loans.

Before we explain these repayment types it’s important you understand some of the terms.

A home loans ‘principal’ amount is the amount you have borrowed from a lender. The interest charge is the amount a lender charges you for the loan (typically each month).

Each month your home loan repayment amount is made up of a ‘principal’ amount and an interest charge. The ‘principal’ amount you pay each month reduces the amount you owe to the lender. So, each month you get a little closer to owning your home outright!

Some lenders will let you pay just the interest charges on your home loan for a limited time (generally 1 – 5 years but can be longer for investors). This helps reduce the monthly repayments but it’s important to remember that you aren’t paying anything off the loan – you are just paying the interest charge to your lender.

It’s important to consider the features and options you want on your home loan because this can make a difference to your repayments depending on your situation. Some of the features you should consider are:

A redraw facility on your home loan lets you withdraw cash from your home loan for other purposes (new kitchen anyone?). This means you can put more money into paying off your home loan knowing that if something comes up and you need some cash you can ‘redraw’ it from your existing home loan.

It’s important to read the fine print from your lender on this because there may be fees and charges that apply, limits to how much you can take out or limits on the number of times you can redraw.

An offset account is where you have a savings or transaction account linked to your home loan. The money you have in this account can ‘offset’ the money you have in your home loan. This means that the interest charged by the lender is calculated on a lower amount. As an example, let’s say you owed $500,000 on your home loan but had $20,000 in your offset account. Your lender would calculate monthly interest on $480,000 rather than $500,000 which would reduce your interest charge.

It’s really important to have the ability to make extra repayments if you can. This will give you the opportunity to pay off your loan faster and own that dream home sooner! Check with your lender to see if you have this feature.

Alright, this is really important and we think you will love it!

The government recently introduced awesome legislation called Best Interest Duty. The reason we think it’s awesome is that it means you can take comfort in knowing that we MUST act with the best interests of consumers. It also requires us to prioritise consumers’ interests when providing credit assistance.

This means that when you work with Loan Comparison Genius you will have peace of mind knowing that we are legally required to act in your best interests and put your interests first.

Here is an example of how this benefits you. As part of the process of working with us we will scan our panel of lenders and present more than 1 option for your situation. This will give you the opportunity to select the right loan option for your needs. All with the comfort of knowing we must act in your best interest. You cannot get fairer than that!

What’s really interesting is that this does NOT apply to banks because they only sell their own products. Those products may or may not be a good fit for you, but they can act in their own interest rather than yours. We don’t think you’ll like that.

In summary, we are on your side and the Best Interests Duty law ensures that. Start the process now to find a home loan that suits your needs.

When looking for a home loan many Australians just go straight to one of the big banks. While they are good options you might not get the right loan for your situation. Today there are so many lenders in the market you might find a better deal that suits your situation from:

Other smaller banks

Mutual banks

Credit unions

Building societies

Other non-bank lenders.

With so much competition in the Australian market make sure you spend the time to compare home loans across many different types of lenders. We can help you find the home loan that suits your situation and you could save serious money – all while you sit back and relax and we do all the hard work. Start our easy and fast home loan process now.

We have described variable, fixed and split rate home loans above.

There are also other types of home loans to be aware of:

Australians love investing in property. Borrowing money for an investment property can have specific criteria, interest rates, repayment options and other conditions. Make sure you talk to us to ensure you are aware of all the options. Alternatively, you can start the process through our online application form.

Sometimes you are really keen to buy a home but don’t have enough deposit. Generally lenders want at least a 20% deposit but it’s still possible to get a home loan if you have less. Not all lenders will provide a low deposit home loan but we can help determine if you are eligible and which lender you should consider.

A guarantor home loan is where you have someone provide additional security, or collateral, for your home loan. Most lenders prefer the guarantor to be a close relative of the person taking the home loan. If you have less than the required deposit this can be an option for you. It can also be a way to save money by not paying a Lenders Mortgage Insurance (LMI) premium.

If you are looking for information on home loan refinancing make sure you read our detailed article on how you can save money.

Most people when they buy a home don’t have all the money they need to complete the purchase. They might have a deposit but still need some help to get the remaining money to buy their dream home. A home loan is the money you borrow from a bank or lender to purchase a property.

Usually the loan is secured against the property and paid back over 25 - 30 years. Over this time you will pay back the amount borrowed plus interest on the loan.

Because the loan is so large it’s really important to shop around for the best deal so you can save serious money and payoff your home loan sooner. That’s where we come in. At Loan Comparison Genius our mission is to save you money on your home loan. Sit back and relax while we do all the hard work of finding the right home loan for your situation.

Our expert services are free for most home and investment loans. We get paid by the lender for doing the work that would otherwise be done by a bank or lenders administration staff so you pay the same rate (or sometimes better) as if you went to the lender directly.

The Loan Comparison Genius key difference is that, unlike a bank, we can help you choose from a wide variety of lenders and get the best option for your needs from our panel of over 27 lenders.

We will only charge an administration fee for certain types of personal loans, business loans or short term loans. If you refinance or exit a home loan that we arrange within the first two years we may charge you a brokerage fee.

So, sit back and relax while we do all the hard work of finding you a great home loan for your situation from our panel of lenders.

Let’s face it - getting a housing loan is a big deal. It’s one of your biggest monthly expenses! If you shop around you can save serious money. However, shopping around can be confusing and time consuming. At Loan Comparison Genius we take the pain out of getting a home loan. We do the hard work for you so you can skip hours of work when you apply online.

We’ll listen to your situation and find the best match for your personal circumstances from our panel of over 27+ lenders (from big banks, credit unions, building societies and specialist lenders).

Loan Comparison Genius is 100% privately Australian owned. We aren’t owned by the banks or other lenders so we are free to act in your best interests.

The loan to value ratio (LVR) is the amount you are borrowing for your home loan as a percentage of the lender’s valuation of the property you’re buying. For example, a bank may approve your loan for 75% of the property value – an LVR of 75% – in which case you would need to pay the remaining 25% as your deposit. So, if you wanted to buy a house that was valued at $400,000 a lender may approve you for an LVR of 75% which means they would lend you $300,000. In this case you would need to have a deposit of $100,000. Generally, a lender’s best mortgage rates are reserved for borrowers with a low LVR.

Lenders Mortgage Insurance (LMI) is a type of insurance that your lender takes out in case you do not pay back the loan. The borrower pays for this insurance. LMI usually applies to home loans with a higher LVR (more than 80%).

It only takes 10 minutes to kickstart the process. Includes a FREE no obligation consultation with a certified Genius.

Our geniuses go to work to find the right deal for your situation from a panel of over 27 lenders. All without hurting your credit rating.

We’ll present 3 great options and help you chose your preferred lender with complete transparency of rates and fee’s.

Sign the loan documents and buy that dream house (or refinance) knowing you've saved serious money on your home loan.

We'll find a great deal from over 27+ lenders (from big banks to building societies, credit unions and specialist lenders) which can save you serious money on your home loan.

We combine cutting edge technology with our experienced team to find you the lowest possible rate for your circumstances

Applying for a loan won’t impact your credit score until you are ready to proceed

All lender fees and charges are fully disclosed upfront so you know exactly what it’s going to cost.

We’ve built a simple, easy and secure online system to fast track your loan request

We can help accelerate the approval process so you get into that dream home fast.

Our geniuses will provide you with advice that’s free of the shackles of big bank ownership.

We are legally obligated to act in your best interests and put you first. Banks don't need to do this.

We get a buzz from our happy clients

Loan Comparison Genius is the business name of Loan Comparison Genius Pty Ltd (ABN 17 719 332 325). Credit Representative number 528539 is authorised under Australian Credit Licence 384704. Disclaimer statement: Your full financial situation will need to be reviewed prior to offer or acceptance of any offer or product. We promise we will never sell your email address to any third party or send you nasty spam.

Loan Comparison Genius is a proudly, privately owned, Australian business. Our goal is to help Australians find the right loan for their circumstances and make the process fast and easy. Although we compare many products from over 27 lenders we don’t cover the whole market or compare all features and there may be other products, features or options available to you.

Made with love in Melbourne Australia. © 2023. All rights reserved.