Click on a mistake above to deep dive into the answer or scroll below.

There are 3 common mistakes property investors make that limit their growth.

In partnership with LongView, a specialist property management and advisory group, we found that avoiding these three common mistakes will see you well on the way to investment property success.

At LongView we specialise in helping clients buy the right property that meets both their personal and financial goals.

Having assisted hundreds of home buyers and investors, we have found that purchasing the wrong type of property is one of the key mistakes people make.

To avoid this, we have developed a data driven framework outlined below. Feel free to use it as you evaluate your next property move or book a time with our team to discuss in more detail.

The LongView Property Investment framework

Let’s start with a quick quiz.

Which of the properties below, all purchased in 2009 for $310k-390k, has been the best investment over the last decade?

To answer this question let’s use our investment framework to help you determine which property might be a better long-term investment.

The LongView investment framework considers the following variables:

Let’s go through these one by one.

The Australian population has grown from around 19 million in 2000 to over 25 million in 2021.

That’s around a 30% increase.

The Government is forecasting a population of almost 39 million in 2060. This would be a 50% + increase over today.

From a macro perspective, this strong population growth helps drive property prices higher and higher.

But while the saying “a rising tide lifts all boats” is often true you must check the population trends in the area you are considering purchasing.

Is the local population increasing or decreasing?

Is the local population getting younger or ageing? If it’s getting younger, it could be an excellent sign of future property price increases.

Answering these key questions will give you a sense of future demand around the property you are considering.

If you think the population will grow, and will have the right age profile, you could be on a winner.

There is a very important saying in property investment: “Land appreciates, buildings depreciate”

Before we explain this let’s define what we mean by land content.

Example 1: low land content.

If a property is worth $400,000 with land value at $100,000 and the building valued at $300,000, then the land content is 25%.

Example 2 – high land content

If a property is worth $400,000 with land value at $320,000 and the building valued at $80,000, then the land content is 80%.

The reason it’s important to understand the land content of a property is that, over time, the land component of a property in a good location will increase in value while the building will slowly depreciate.

That’s because buildings require maintenance as they get old or damaged and that can cost landlord’s significant amounts of money. It’s a key reason why building depreciation is often a tax deduction.

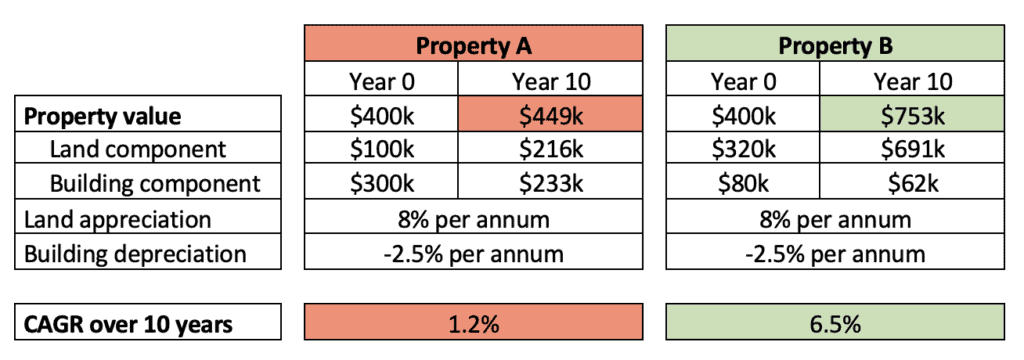

To explain this further let’s walk you through an example of two properties in the same suburb. In both cases below you will see that land appreciation is 8.0% per annum while building depreciation is 2.5% per annum.

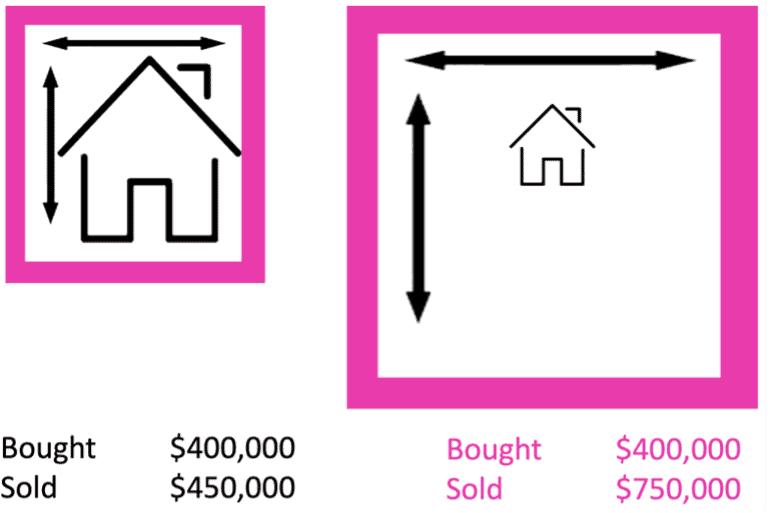

In this example both properties are purchased for $400,000. After 10 years, property A is sold for $449,000 while property B is sold for $750,000.

So, buying high land content can have a huge impact on investment property returns.

If we come back to our original question of which of these properties is the better investment, let’s look at the land content.

You can see in the above that the Pascoe vale property has a high land content while the Windsor property has a low land content. This simple calculation can give you a strong indication of which property might perform better over time.

Disclaimer

The information in this document is for general information only and should not be taken as constituting professional financial advice from LongView or Loan Comparison Genius. LongView/Loan Comparison Genius is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information contained in this document relates to your unique circumstances. LongView or Loan Comparison Genius is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided to you in relation to your investment property portfolio.

Mortgage broking services are provided by Loan Comparison Genius Pty Ltd (ABN 17 719 332 325). Credit Representative number 528539 is authorised under Australian Credit Licence 384704. Property Management, Buyer Advisory, Property Sales, Vendor Advocacy and Owners Corporation Management services are provided by LongView Real Estate Pty Ltd (ABN 63 113 387 072). Disclaimer statement: All applications are subject to specific lending criteria. Your full financial situation will need to be reviewed prior to offer or acceptance of any offer or product. We promise we will never sell your email address to any third party or send you nasty spam. The information collected from the customer will only be used by Loan Comparison Genius and LongView. Please read our privacy policy for more information.

Loan Comparison Genius is the business name of Loan Comparison Genius Pty Ltd (ABN 17 719 332 325). Credit Representative number 528539 is authorised under Australian Credit Licence 384704. Disclaimer statement: Your full financial situation will need to be reviewed prior to offer or acceptance of any offer or product. We promise we will never sell your email address to any third party or send you nasty spam.

Loan Comparison Genius is a proudly, privately owned, Australian business. Our goal is to help Australians find the right loan for their circumstances and make the process fast and easy. Although we compare many products from over 27 lenders we don’t cover the whole market or compare all features and there may be other products, features or options available to you.

Made with love in Melbourne Australia. © 2023. All rights reserved.