Click on a mistake above to deep dive into the answer or scroll below.

We are going to explain why property A performed the best by explaining the 3 common mistakes property investors make that limit their growth.

In partnership with LongView, a specialist property management and advisory group, we found that avoiding these three common mistakes will see you well on the way to investment property success.

At LongView we specialise in helping clients buy the right property that meets both their personal and financial goals.

Having assisted hundreds of home buyers and investors, we have found that purchasing the wrong type of property is one of the key mistakes people make.

To avoid this, we have developed a data driven framework outlined below. Feel free to use it as you evaluate your next property move or book a time with our team to discuss in more detail.

The LongView Property Investment framework

Right at the start of our quiz we asked which of the properties below, all purchased in 2009 for $310k-390k, has been the best investment over the last decade?

To answer this question let’s use our investment framework to help you determine which property might be a better long-term investment.

The LongView investment framework considers the following variables:

Let’s go through these one by one.

The Australian population has grown from around 19 million in 2000 to over 25 million in 2021.

That’s around a 30% increase.

The Government is forecasting a population of almost 39 million in 2060. This would be a 50% + increase over today.

From a macro perspective, this strong population growth helps drive property prices higher and higher.

But while the saying “a rising tide lifts all boats” is often true you must check the population trends in the area you are considering purchasing.

Is the local population increasing or decreasing?

Is the local population getting younger or ageing? If it’s getting younger, it could be an excellent sign of future property price increases.

Answering these key questions will give you a sense of future demand around the property you are considering.

If you think the population will grow, and will have the right age profile, you could be on a winner.

There is a very important saying in property investment: “Land appreciates, buildings depreciate”

Before we explain this let’s define what we mean by land content.

Example 1: low land content.

If a property is worth $400,000 with land value at $100,000 and the building valued at $300,000, then the land content is 25%.

Example 2 – high land content

If a property is worth $400,000 with land value at $320,000 and the building valued at $80,000, then the land content is 80%.

The reason it’s important to understand the land content of a property is that, over time, the land component of a property in a good location will increase in value while the building will slowly depreciate.

That’s because buildings require maintenance as they get old or damaged and that can cost landlord’s significant amounts of money. It’s a key reason why building depreciation is often a tax deduction.

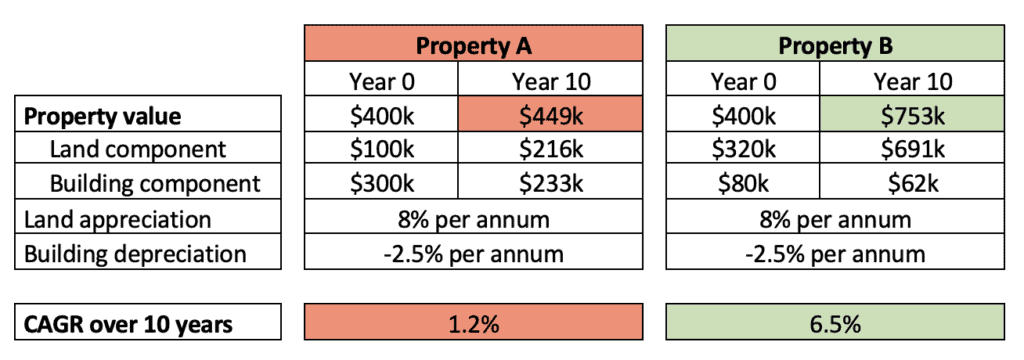

To explain this further let’s walk you through an example of two properties in the same suburb. In both cases below you will see that land appreciation is 8.0% per annum while building depreciation is 2.5% per annum.

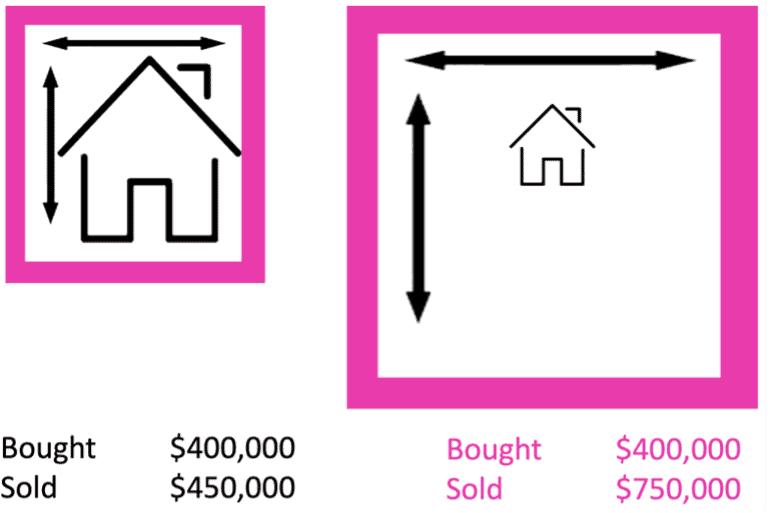

In this example both properties are purchased for $400,000. After 10 years, property A is sold for $449,000 while property B is sold for $750,000.

So, buying high land content can have a huge impact on investment property returns.

If we come back to our original question of which of these properties is the better investment, let’s look at the land content.

You can see in the above that the Pascoe vale property has a high land content while the Windsor property has a low land content. This simple calculation can give you a strong indication of which property might perform better over time.

I’m sure you’ve heard of the natural law of supply and demand. In property, when supply is tight and demand is strong prices go up.

When you are researching a property consider how unique or rare the property is, particularly the land component. As an example, standalone properties within 5-10 kilometres of the CBD are a finite resource as it’s difficult to create more land in this radius. Couple this with people’s desire to live close to the CBD and you generate land scarcity.

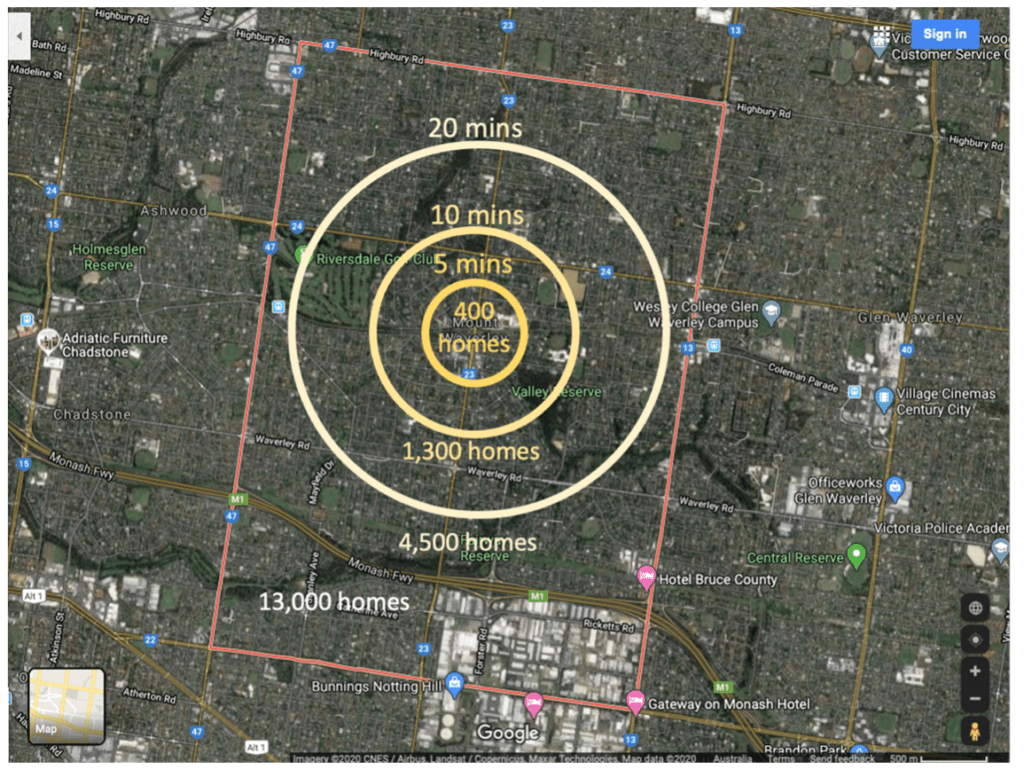

In the example below you’ll see that there are only a certain number of homes in close proximity to a train station, making those properties scarce. This gives them the potential to significantly appreciate over time.

Proximity to train station:

One day you may need to sell your investment property and one of the best ways to maximise its sale price is to have lots of buyers bidding for it.

To do this you want to have a property that appeals to a broad range of buyers. For example, imagine the competition for your property if you had families looking to buy it as well as developers looking to build multiple units.

As an example, look at the three properties below.

Each property is on a similar size block but the prices vary significantly.

You’ll see in the image above that the first property is in a development zone and garners a high price per square metre ($1,415 per sqm) while the second property is in a ‘residential zone’ and therefore achieves only $1,079 per square metre.

So it’s important to do your research on a property. Are there heritage overlays that would restrict development? What is the council zoning and are there limits to the number of units that can be built on your property?

Selecting a property with development potential can significantly increase the competition for your property should you sell.

There are several factors you should consider when evaluating a property as an investment.

With all of this background why do people buy the Windsor property over the Pascoe vale property?

They get fixated on rental yield as shown below:

Rental yield is important (see mistake number 2 below for discussion on this), but when you look at TOTAL returns, capital growth far outweighs rental yield:

Over 10 years the Pascoe Vale property outperforms all others. It had high land content, was in a good location (scarcity, amenities) with development potential. This means there is a wide variety of buyers competing for it.

Follow these principles and you’ll avoid some of the key mistakes we see property investors make and have a higher chance of buying an investment property that will deliver strong returns.

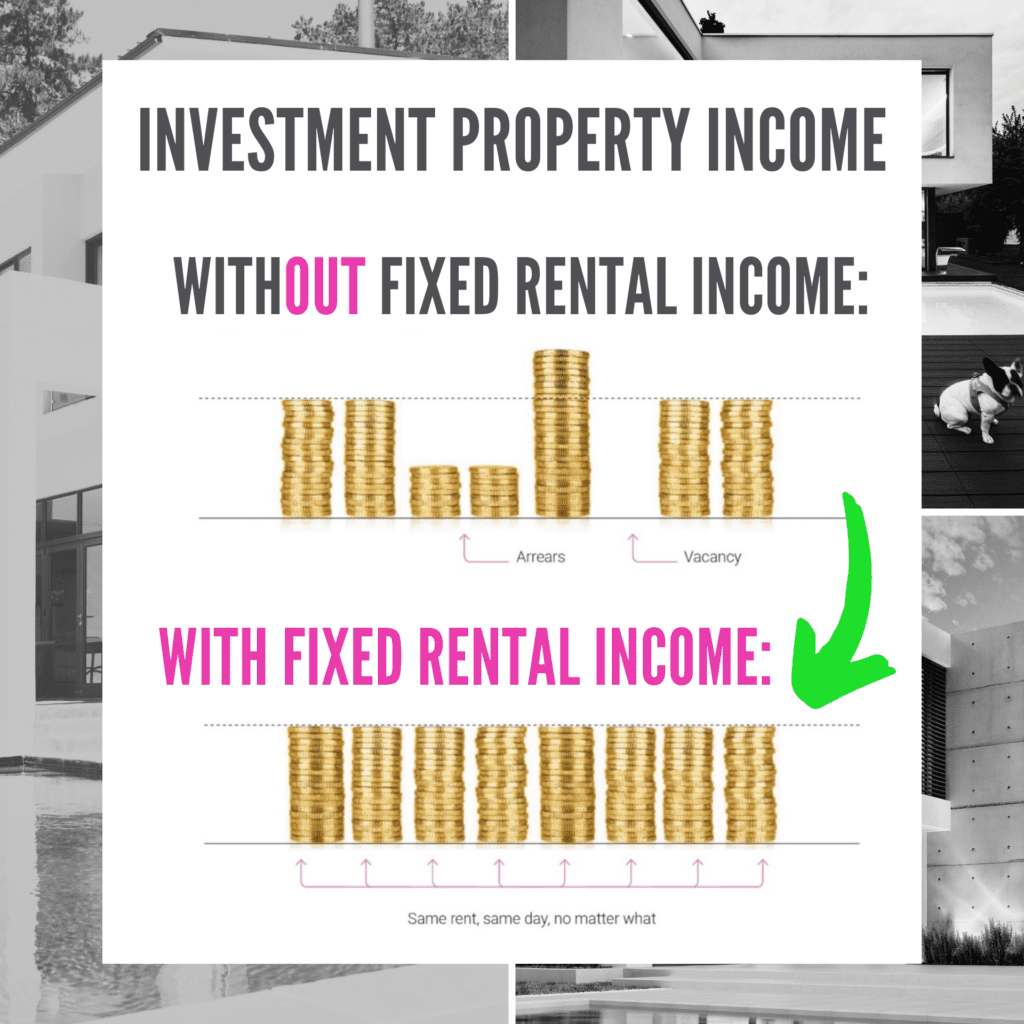

While capital growth is critical, rental income does play a strong role for property investors as it can provide valuable cashflow while you own the property.

But there is a problem with rental income.

It can be unreliable and lumpy.

Why? Sometimes your investment property can be vacant leaving you absolutely no income.

Other times tenants can fail to pay as a result of financial issues, or they can be late paying.

Unfortunately, this causes some property owners to be late paying their investment property mortgage.

That’s why the team at LongView developed their fixed rent product.

This is the ultimate peace-of-mind service and one which no other real estate agency in Melbourne will offer you.

If you want certainty that your rent will be there on the same day, every month, no matter what—whether the property is let or vacant, whether the tenant is on time or not— LongView provide a fixed rent service to you.

So how does it work?

Simply let us know your investment property address (or the address of the property you are considering purchasing) and the period you want your fixed rent quote to be for (between 2 – 5 years).

The team at LongView will then run a full assessment of your property and provide a fixed rent quote including full property management to make the whole process hassle free.

You then simply nominate the day of the month you would like the fixed rental payments, with the first payment made within 10 business days.

You will never have to worry about meeting your mortgage payments or losing a tenant as your rent is locked in for the agreed period.

By using LongView fixed rental you will lock in your rental income and have that all important peace-of-mind knowing your cashflow is locked in.

With your cashflow secure let’s move to the 3rd mistake we see.

This is an area many property investors don’t get right.

Whether you can buy an investment property or not is heavily dependent on your borrowing power or ability to service a loan.

This means lenders will decide if they will lend you money based on your ability to pay down debt.

If you don’t consider your borrowing capacity, or don’t structure your loans correctly, you may be limiting your ability to grow your investment property portfolio.

So, what do you have to consider to get your borrowing capacity and loan structures right?

Here are 7 key factors to consider when assessing your borrowing capacity and loan structure:

Don’t fall into the trap of thinking these are straight forward. Let’s go through them one by one.

I’m sure you’re thinking that this is pretty simple. The more money you earn, the more you can borrow.

While this is of course true, for many investors calculating income is a little more complex than just looking at your weekly take home pay.

That’s because most investors have more income than just a base salary. They may also have bonuses and overtime that varies, salary sacrifice arrangements or complexities around their income if they are self employed.

Some lenders assess these different types of income very differently. For example, some lenders may include bonuses in your total income while others will discount these bonuses or not include them at all. This is also true for self-employed income, as lenders will assess documents such as tax returns, notice of assessments and BAS statements differently. As a result, your borrowing capacity can vary greatly from lender to lender.

Knowing how each lender assesses income is absolutely critical to determining how much you can borrow. The skill is having a good mortgage broker matching your current income situation to the right lender to ensure you maximise the amount you can borrow (and are able to service the loan).

Again, you are probably thinking this is pretty straightforward. The less debt the more you can borrow.

Of course that is true but sometimes people aren’t aware of some strategies to reduce debts.

For example, we have worked with investment property clients who have multiple loans like a personal loan, car loan or credit card debt. Often at high interest rates. When we combined all of these debts into a simple, and often lower monthly repayment, we are able to increase their borrowing power to help them buy the right properties. Of course, every situation is different, but these types of strategies can be very effective.

If you don’t have any debt we’ll bet you have a credit card (or two). What many people don’t know is that your credit card limit actually impacts your borrowing capacity.

Even though you might pay off your credit card in full every month, your credit card limit still impacts your borrowing capacity. In fact, for every $1,000 you lower your credit limit you may be able to increase your borrowing capacity by up to $6,000 (this varies by lender).

While you may think it’s comforting to have a $10,000 credit card limit for rainy days, it may actually be hurting your borrowing capacity.

So, try to match your credit card limit to what you really need so you don’t hurt your home loan borrowing capacity.

Your rental income and expenses are treated differently by different lenders. Some lenders reduce rental income by 20% to provide a safety buffer to the serviceability of your loan while others may accept tax benefits from negative gearing to help improve servicing. These two examples can dramatically affect your borrowing capacity.

A good broker understands how to navigate these lender criteria to improve your borrowing capacity.

Additionally, the fixed rent product from LongView may be helpful as it provides property investors certainty of income over an agreed period.

Not all lenders are the same and they all have different lending policies. These policies change often according to the clientele they are targeting.

It’s absolutely critical that your mortgage broker understands these policies. This will have several benefits such as:

So, a deep understanding of lender policies can really help with your investment property loan.

Investment property loans are often not as straightforward as they seem. There is much to consider such as:

A popular way to buy an investment property is to use the equity in your existing properties as collateral.

As an example, let’s say your current property is worth $500,000 and you owe $180,000. In this situation your equity would be $320,000.

You can then use this equity towards another investment property. This equity may improve your loan to value ratio allowing you to access better interest rates and avoid paying Lenders Mortgage Insurance (LMI).

However, this is where borrowing power (or serviceability) is so important. You may have a strong equity position but if a lender does not think you can service (or repay) the loan based on your income you will not be able to borrow to purchase the property.

This is why understanding your borrowing power is key. You must understand how much a lender thinks you can afford to pay back otherwise you will not be able to leverage your equity position. A good broker understands each lenders policies and therefore where you can maximise your borrowing power.

Every good property investor has a broker that regularly reviews their loan position. Regular reviews of your property portfolio allow you to:

At Loan Comparison Genius we regularly assess our clients’ portfolios and constantly look for ways to improve their position. For example, sometimes it can be as simple as finding a better rate in the market to reduce monthly repayments using built up equity as a negotiating point with lenders.

As you can see, there is a lot to consider when structuring your investment property loans.

Don’t be fooled into thinking the best investment property loan is the one with the cheapest interest rate. Carefully considering each of these points will result in the selection of a loan and lender that best suits your situation now and into the future.

So those are the three common mistakes we see when people invest in property.

Don’t make these mistakes with your investment property.

For a limited time, we are offering a free consultation to discuss your current position and ways we can help with your investment property strategy.

We can discuss each of the above mistakes in more detail and secure a fixed rent quote for your current property or one you are considering purchasing.

Simply fill out your details below and we’ll be in contact to arrange a discussion.

This level of planning can set the stage for the future growth of your investment property portfolio.

Disclaimer

The information in this document is for general information only and should not be taken as constituting professional financial advice from LongView or Loan Comparison Genius. LongView/Loan Comparison Genius is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information contained in this document relates to your unique circumstances. LongView or Loan Comparison Genius is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided to you in relation to your investment property portfolio.

Mortgage broking services are provided by Loan Comparison Genius Pty Ltd (ABN 17 719 332 325). Credit Representative number 528539 is authorised under Australian Credit Licence 384704. Property Management, Buyer Advisory, Property Sales, Vendor Advocacy and Owners Corporation Management services are provided by LongView Real Estate Pty Ltd (ABN 63 113 387 072). Disclaimer statement: All applications are subject to specific lending criteria. Your full financial situation will need to be reviewed prior to offer or acceptance of any offer or product. We promise we will never sell your email address to any third party or send you nasty spam. The information collected from the customer will only be used by Loan Comparison Genius and LongView. Please read our privacy policy for more information.

Loan Comparison Genius is the business name of Loan Comparison Genius Pty Ltd (ABN 17 719 332 325). Credit Representative number 528539 is authorised under Australian Credit Licence 384704. Disclaimer statement: Your full financial situation will need to be reviewed prior to offer or acceptance of any offer or product. We promise we will never sell your email address to any third party or send you nasty spam.

Loan Comparison Genius is a proudly, privately owned, Australian business. Our goal is to help Australians find the right loan for their circumstances and make the process fast and easy. Although we compare many products from over 27 lenders we don’t cover the whole market or compare all features and there may be other products, features or options available to you.

Made with love in Melbourne Australia. © 2023. All rights reserved.