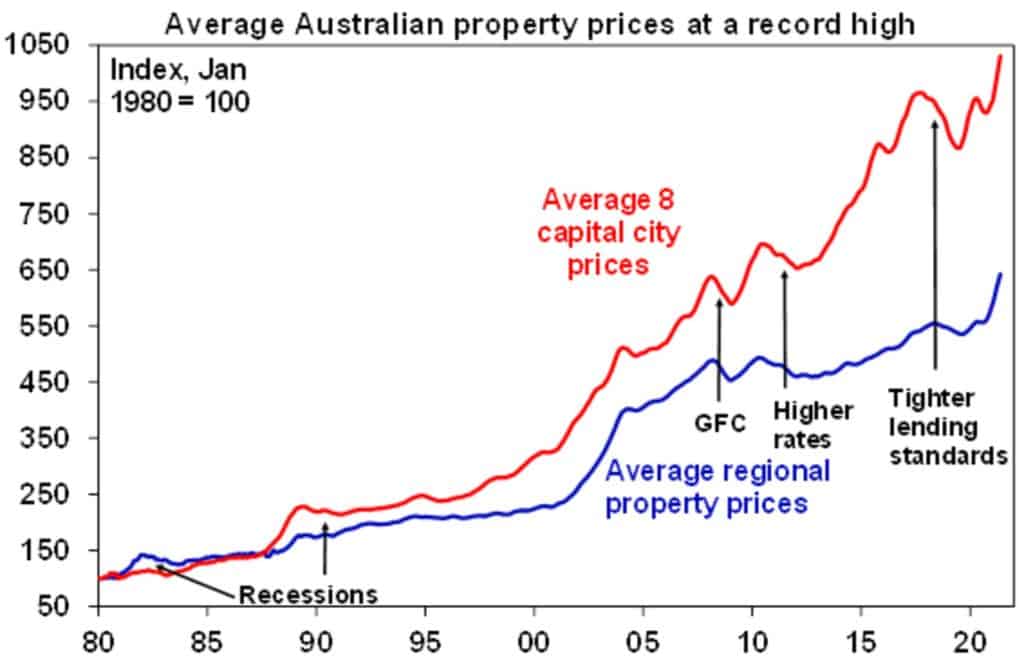

While Australian property prices have shown strong growth for many years (see chart below) there is always a lot of talk about the future of property prices with many ‘gurus’ making bold predictions about either a massive collapse in property prices or continual strong gains.

Source: CoreLogic, AMP Capital

We have never been fans of making short term predictions on property prices. That’s really difficult and highly prone to error.

We prefer to look at long term trends and, very importantly, the key factors that could influence these long-term trends.

So, what are the key factors that could impact property prices long term?

We strongly believe there are 6 key factors you need to watch. Track these factors, combine them with your own research, and you’ll develop a strong sense of what might happen in the future.

Key Factor 1: Population

This is definitely the number 1 factor we watch. Why? Because a fundamental driver of property prices is supply and demand. We will cover supply in the next factor, but population forecasts directly impact demand.

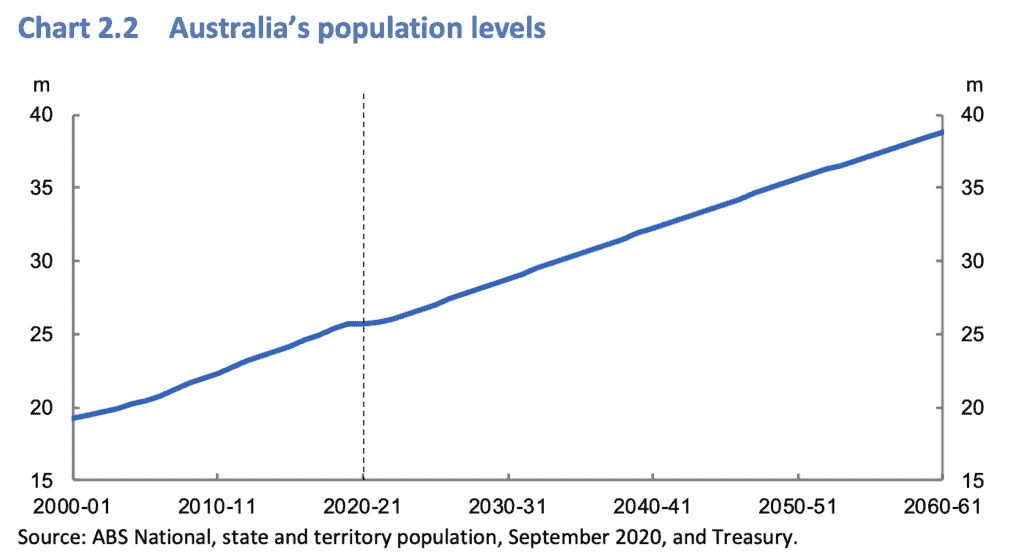

The chart below is from the 2021 Australian Government Intergenerational report. It has Australia’s historical population growth and also a future population forecast.

There are two important points here:

- The Australian population has grown from around 19 million in 2000 to over 25 million in 2021. That’s around a 30% increase.

- The Government is forecasting a population of almost 39 million in 2060. This would be a 50% + increase over today.

So, when it comes to demand we don’t have a problem.

When you look at point 1 it’s pretty clear why property prices have gone up – a 30% increase in population will always provide stimulus to drive property prices north. While many predict a property crash, they continually fail to look at these underlying fundamentals driving property price growth.

Point 2 gives you an indication of future demand. With the government forecasting a 50% growth in population, underlying demand will continue to be strong.

Hot Tip:

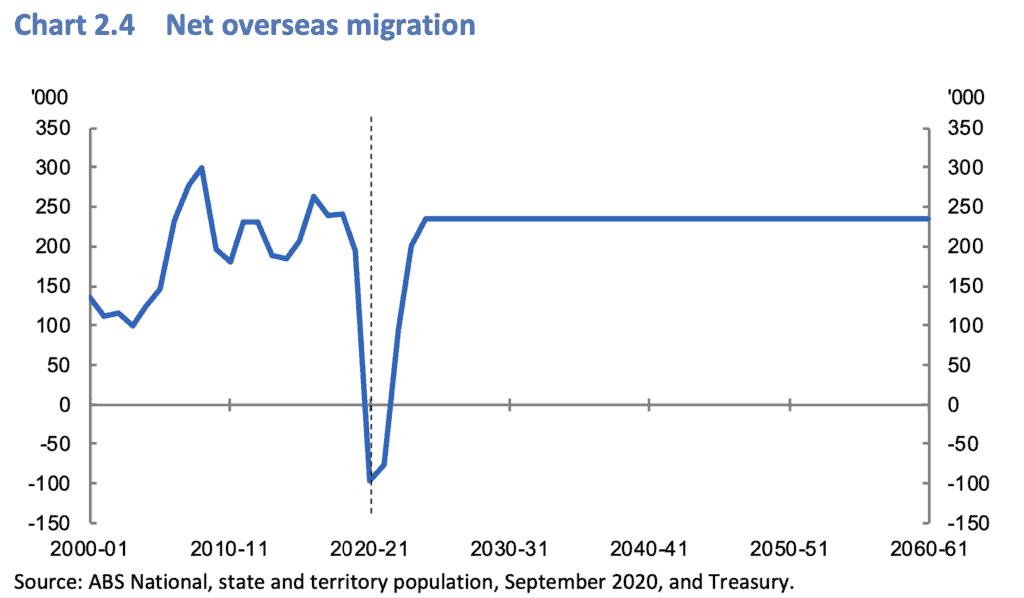

When it comes to watching population trends we also keep a close eye on net overseas migration as this has been a key driver of population growth.

You’ll see in the chart below that the government is sticking with a forecast of 250,000 people (net) coming to Australia each year through to 2061. This gives us a high confidence that the population growth forecast will be achieved.

So, in summary, all indicators point to continued strong population growth in Australia. This will mean demand for housing will be high putting upward pressure on housing prices over the long term.

Key Factor 2: Supply

This is where it gets interesting and where a lot of ‘gurus’ get it wrong.

On the face of it, with so much space in Australia there should be more than ample supply of land for this growing population. In other words, a lot of supply to put a dampener on property prices.

There is just one problem: Australians love living in capital cities!

In Australia the population is highly concentrated in our capital cities and is where most of the recent population growth has occurred. As proof, the Australian Bureau of statistics (ABS) reported that 79% of Australia’s population growth occurred in capital cities.

This is very different to the United States. While the U.S. has a land mass similar to Australia, it’s population is much more spread out right across the continent. The U.S. has 300 cities over 100,000 people (source: United State Census Bureau 2019) versus Australia with just 19.

So, in summary, not only will Australia’s population grow substantially over the coming years but, based on current consumer trends, this population will be concentrated in the capital cities. While new growth corridors are opening up on the city fringes, house prices will be pushed up because of people’s desire to live closer to the centre of a major capital city.

Commonly asked questions:

Won’t major new land releases on a city’s fringe increase supply substantially?

This is true but remember that people love living close to the CBD of a capital city. It’s difficult to create new property close to the city. Yes, apartments are going up fast but see our next FAQ for our point of view on apartments.

Apartments are going up everywhere – won’t that provide an oversupply?

It’s true that apartment construction is going ahead fast. This will result in an oversupply of apartments but not houses. Australians are showing a strong preference for living in a house rather than an apartment if they can afford it. This preference may change in the future – see our discussion on mega trends below.

Key Factor 3: Interest rates

This is pretty obvious. The lower the interest rate the cheaper a home loan is. This means homeowners can borrow more which results in them being able to bid higher for a property. When you combine this with a higher population and tight supply, property prices go up.

Of course, the reverse can be true. If interest rates rise in the future we would expect to see a slowdown in property price growth.

So, watch what is happening with interest rates and you’ll get a strong feeling for the potential movements in property values. Don’t forget to make sure you shop the market for a home loan to ensure you are saving money. Our article on how to compare home loans is really helpful.

Key Factor 4: Policy or Regulation Changes

A few years ago regulators like the reserve bank were worried that investors were driving property prices up. The response was to increase interest rates to property investors to try to cool down property investment. It worked and slowed down house price growth.

Keep an eye out for these sorts of policy changes and assess how they may impact property prices.

Key Factor 5: Government stimulus

The Australian Government over the years has been presented with challenges like the economic shock from COVID, the global financial crisis of 2008 or the need to help first home buyers into a new property. A common response to these challenges is to stimulate new home construction through government grants for first home buyers or single parents.

These stimulus packages have a major effect on boosting new home construction and the general economy. If you see the government launching these types of programs, then often house prices can track upwards.

Key Factor 6: Consumer mega trends

It’s important to keep an eye on consumer mega trends as they can have a significant impact on property prices. Here are just a few examples:

Trend 1: The desire to live in a capital city

As is shown in the ABS data, most of Australia’s population growth is occurring in the capital cities. The key driver behind this is that Australian’s love the city lifestyle. This is an important trend to watch as it means that demand is highly concentrated in just a few areas. The result is upwards pressure on property prices in the capital cities.

Trend 2: The desire to live close to the centre of a capital city

This is another consistent theme and has resulted in strong gains for inner city property. It also has fuelled apartment purchases as people who cannot afford to purchase house and land in the inner city opt for apartment living to stay close to the central business district.

Trend 3: Sea change

Many people look for a change from the hustle and bustle of city life and opt for a more relaxed lifestyle in the country or seaside areas. There are other financial benefits including much more affordable property. Up until now this has been a minor trend but COVID may be changing this. Many people lived in the city because of work commitments and simply couldn’t commute several hours per day from a seaside town. With many employers now offering more flexible work arrangements suddenly people are thinking that perhaps they can move to a seaside town or into rural areas and work from home (or are ok with a long commute just one or two days per week). Watch this mega trend carefully as it would challenge the population concentration we are seeing in the capital cities. If this became a serious trend then supply would free up considerably and upward pressure on property prices in capital cities could ease.

Trend 4: Apartment living

Australians have longed dreamed about a house on a quarter acre block but with property prices rising so much apartments have become a real option for those wanting to buy their own property or live closer to the city. If Australians become comfortable with apartment living (especially families) this could reduce the urban sprawl we are seeing and change supply and demand dynamics as there is plenty of apartments coming to market.

We aren’t suggesting these are all the consumer mega trends you should watch out for but it’s important to be aware of how these trends will impact property prices.

Summary

As you can tell, rather than listening to ‘gurus’ making claims about property price crashes or booms, we like to stick with the data and monitor these key factors.

We aren’t suggesting property prices will go up continually in a straight line. Property prices never do that. We just think if you combine your own research (always a must) with these key factors you’ll have a better chance of making better property investment decisions.

Of course, if you need help to understand what your borrowing capacity is to support your next property investment give us a call or start the process to find your rate. We also have the following articles you may find helpful:

FAQs

We believe there are 6 key factors to consider when assessing which way property prices may go in the future. These factors are population trends, supply trends, interest rates, policy and regulation, government stimulus and consumer mega trends.

We think forecasting property prices in the short term is pretty tough as many things can impact short term prices. We prefer to focus on long term price trends and therefore follow the key factors in this article. Of course, do your own research and seek your own advice.

Let’s face it - getting a housing loan is a big deal. It’s one of your biggest monthly expenses! If you shop around you can save serious money. However, shopping around can be confusing and time consuming. At Loan Comparison Genius we take the pain out of getting a home loan. We do the hard work for you so you can skip hours of work when you apply online.

We’ll listen to your situation and find the best match for your personal circumstances from our panel of over 27+ lenders (from big banks, credit unions, building societies and specialist lenders).

Loan Comparison Genius is 100% privately Australian owned. We aren’t owned by the banks or other lenders so we are free to act in your best interests.