We all like to keep up to date on the latest property news but we don’t want to spend hours reading about it.

So this post will provide you the 5 things you need to know about the Australian property market in 60 seconds (November).

You’ll note we are a big fan of data so expect to see real data from trusted sources.

1. Nationally, October housing prices increased 1.5%

Nationally, October housing prices increased 1.5%. Very healthy growth but slower than the March peak of 2.8%.

Some key points:

- Brisbane had the biggest growth at 2.54% while Perth was slightly negative at -0.11%.

- Houses are performing better than units. October house prices up 1.6% vs units up 1.2%.

- Year to date houses are up 21.3% vs 12.7% for units. Source: Corelogic Home Value Index.

2. Regional markets performing better than Capital city markets.

Corelogic says regional markets grew 1.9% in October vs 1.4% in the capital cities. In the past 12 months regional markets are up 24.3% vs 20.8% for the capital cities.

Combine this with Australian Bureau of Statistics data showing net migration moving towards regional areas and it looks like there are a lot of people looking for a sea change. See chart below.

We continue to watch these trends carefully as they can impact general property price trends as highlighted in our article 6 Key Factors That Impact Property Prices.

3. Property is selling fast.

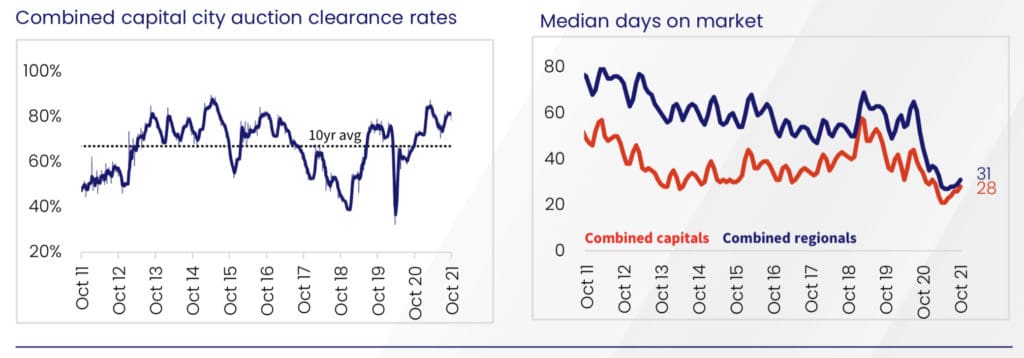

The charts below show clearance rates are well above the 10 year average. The median number of days a property is on market is one of the lowest in the last 10 years.

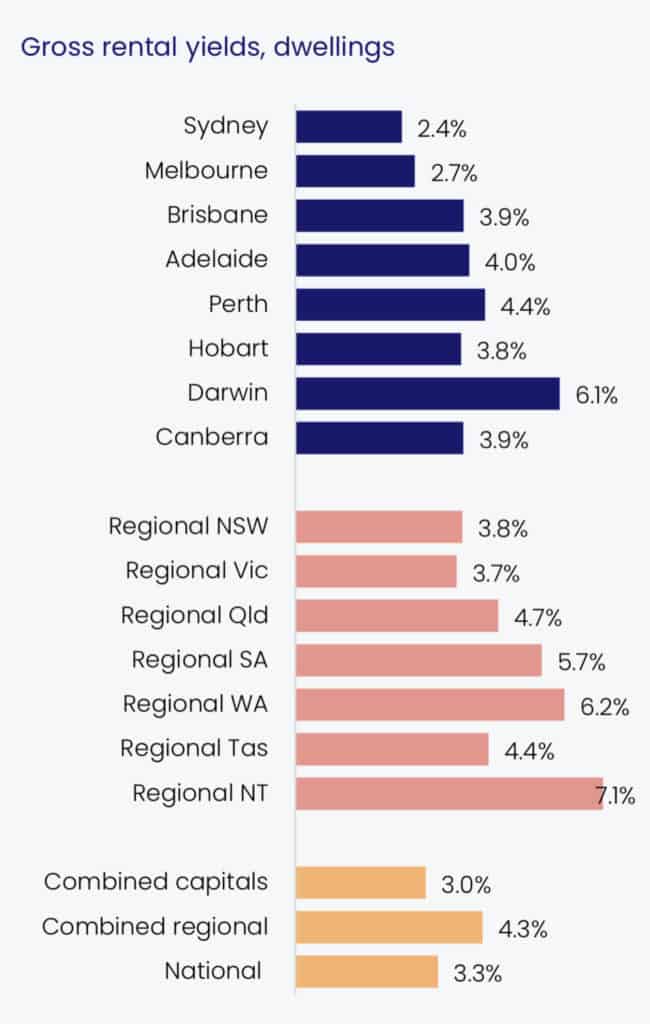

4. Rental yields fell in October

Rental yields fell in October to a record low of 3.27% nationally according the Corelogic. Although rents were up 0.7% nationally, they just aren’t keeping up with the strong increases in property prices.

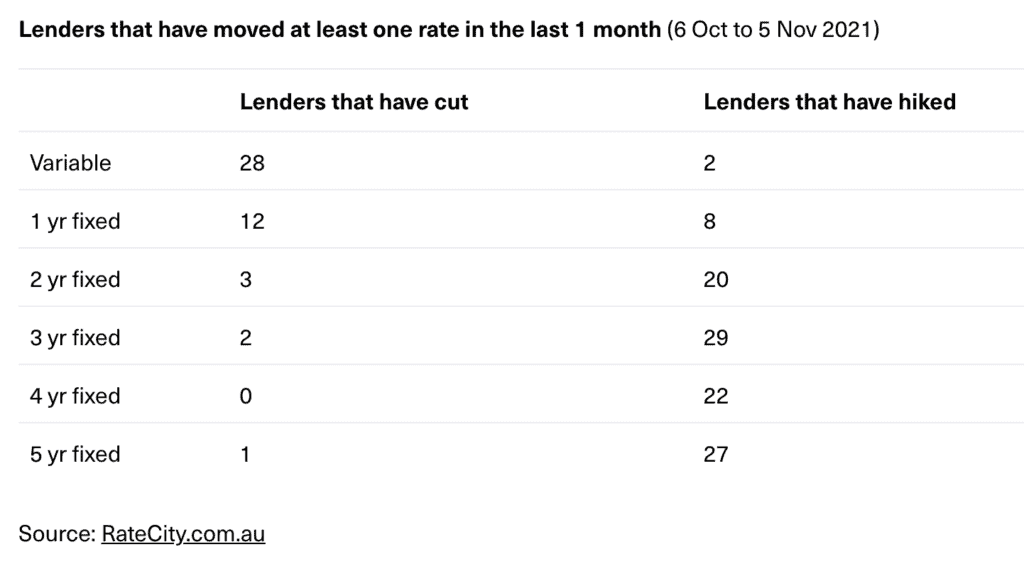

5. Longer term fixed home loan interest rates are increasing.

You’ll see in the chart below from Rate city that while more lenders have cut current variable and 1 year fixed rates, there is a growing number of lenders who are increasing their 2 year and longer fixed rates.

There seems to be a growing expectation that interest rates will move up over the medium to long term. Might be a good time to consider locking in a better interest rate. Feel free to talk to us about your options and if this is the best plan for your situation.

And there are 5 key things you need to know about the Australian property market.

Of course, if you need help to understand what your borrowing capacity is to support your next property investment give us a call or start the process to find your rate. We also have the following articles you may find helpful: